One quick potentially profitable trade I am looking at is in bonds. I’ll keep this one quick.

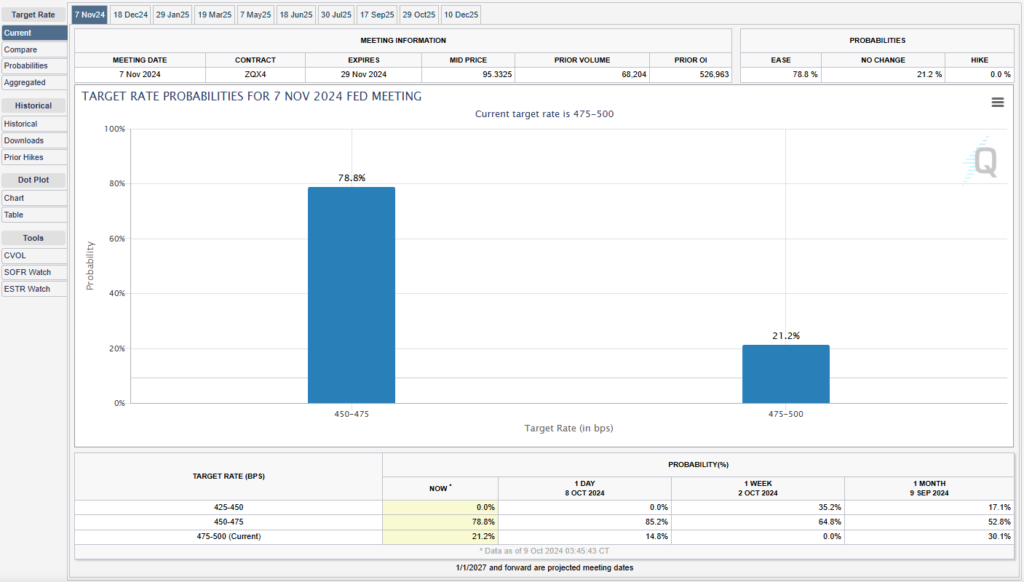

Yields rallied significantly across the curve since the Sept 18 FOMC meeting where Jerome Powell cut benchmark rates by 50bps (sounds counter-intuitive? you must be new here.) The bond market tanked on concerns of reigniting inflationary pressures by cutting aggressively into growth. We’ve had a “fake” growth scare in early August introduced to you by none other than the comedy show that is called Non-Farm Payroll which caused a bid for bonds not seen in a while. Now, after a slug of econ data, all of that crowded positioning was unwound, and the bond market is pricing 2- 25bps cuts for Nov and Dec FOMC meetings.

Now, the bond market has sold off more than enough to warrant a tactical long trade here. with CPI tomorrow and geopolitical risks intensifying, perhaps it’s not such a bad risk/reward trade. Bonds are technically oversold on the hourly as well as on the daily, and Price/RSI are diverging on the hourly. With sentiment getting so sour, if CPI comes in line tomorrow, we could see a massive rebound in long duration to fill the 10/4 NFP gap. It is still a tossup, but it looks good enough for me to pull the trigger.

$TLT 10/11 95.5/96.5 bull calls are selling for 20c but I wouldn’t listen to me. Check My Mistakes if you still insist on doing so.

EDIT: I was wrong. CPI came in hotter than expected and those spreads went to options heaven.

HANNIBAL.

Leave a Reply